atc income tax india

Ahead of budget 2022-23 here is a review of income tax rates during the outgoing fiscal year Estimatedprojected budget 2022-2023 Moodys downgrades 5 Pakistani banks outlook to negative from. As per the new rule a taxpayer filing GSTR-3B can claim provisional Input Tax Credit ITC only to the extent of 10 of the eligible credit available in GSTR-2A.

This job was grate it helped me learn a lot of new thinngs in a new work enviorment.

. Name A - Z Ad All Accounting Services. Before discussing this allowance let me explain a bit about the term. Section 80C of Income Tax Act is applicable only for individual taxpayers and.

The amount of eligible credit is arrived upon those invoices or debit notes the details of which have been uploaded by the suppliers in the GSTR-2A only. Ignoring PF and Gratuity for ease of understanding. Celebration of Income Tax Day 2021 Hosting of Web Conference for Officers and Officials of the department - regarding.

There are 2 helpful reviews. Perks is yet to be decided. WALCHANNAG Dear Sirs WALCHANDNAGAR INDUSTRIES LIMITED.

Commonly known as basket of benefits. Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax. Reviews from ATC Income Tax employees about ATC Income Tax culture salaries benefits work-life balance management job security and more.

A resident company is taxed on its worldwide income. Answer 1 of 4. These allowances can be c.

A maximum of Rs150000 can be asserted for. Legal Name ATC Financial LLC. The limit is capped at 15 lakh aggregate of 80C 80CCC and 80CCD.

Company Type For Profit. Income-tax Return Forms for Assessment Year 2022-23. The new section 80C has become effective wef.

CBDT extends last date for. Get Refund Advance up to 500 1 No Credit Check. Tax Rates DTAA v.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. Headquarters Regions Greater Atlanta Area East Coast Southern US.

Tax deductions under Section 80CCD are categorised in three subsections. For JE-ATC this can be approximately INR 8000 Income tax will be depending on how much. Also Known As ATC Financial.

Was this review helpful. The CTC offered by the company generally includes two components namely the basic salary and all the allowances like food house rent travel dressing LTA etc. This income tax exemption is allowed to HUF members as well as non-HUF members.

Copyright 2021-2022 ATC Financial LLC. Us 80C you are able to reduce Rs150000 from your taxable income. Stay logged in.

Here comes the real reward of being an ATC Officer in India. 15 days salary on the grounds of the salary for each finished year of service or the portion thereof in excess of 6 months that is 1526 Salary pm. Atc Income Tax in Indian Creek FL.

ATC India is an indirectly-held subsidiary of American Tower Corporation. Of years of completion of service. However this new section has allowed a major change in the method of providing the tax.

A resident company is. Bank of India Recruitment 2022 Admit Card. Tax deductions under Section 80CCD are.

A maximum of upto 10 of salary for employees or 20 of gross total income for self-employed individuals. Promotion to the grade of Assistant Commissioner of Income-Tax ACIT. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML.

The amount of the advance 200 to 500 will be deducted from tax refunds and. Find your nearest ATC Income Tax offices and make an. Even the section 80CCC on pension scheme contributions was merged with the above 80C.

Employee Contribution Under Section 80CCD 1. ATC Income Tax benefits and perks including insurance benefits retirement benefits and vacation policy. Insertion of rule 16DD and form 56FF to the Income-tax Rules 1962.

Towards the intention of the mentioned calculation the salary will be rendered as basic salary per month along with the Dearness. Reported anonymously by ATC Income Tax employees. Atc Income Tax India.

Income Tax Gratuity Social Security Schemes and Pension do remember all AAI employees get Pension after retirement. O Tax Preparer Current Employee - 27th state milwaukee wi - June 4 2013. 21 This Act may be called the Income-tax Act.

Section 80C replaced the existing Section 88 with more or less the same investment mix available in Section 88. A maximum of Rs150000 can be asserted for the financial year 2021-2011 2022-2023 each. Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax.

Tax Return Preparation Bookkeeping Accounting Services 3 Website Directions More Info. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Atc Income Tax India.

What Is The Approximate In Hand Salary Of An Atc After 3 Years On The Job Quora

Business Cards Tagged Tax Services Near Me Terminalgr

What Is The Income Tax Slab Rate For Ay 2020 21 Quora

What Is Salary Of Assistant Manager Atc After Promote From Junior Executive Quora

Atlantataxes Twitter Search Twitter

What Is The In Hand Monthly Salary Of A Junior Executive Electronics Aai Quora

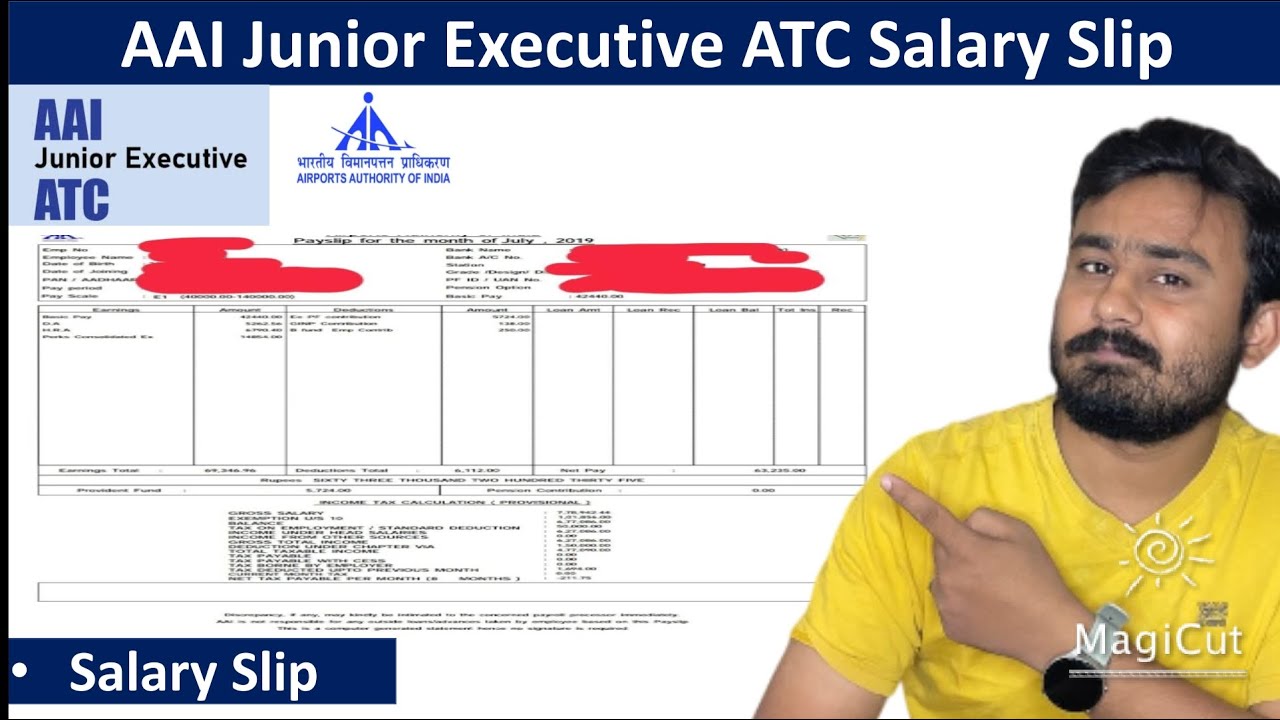

Aai Junior Executive Salary Slip Aai Junior Executive Perks Allowance Sarkari Naukri Vale Baba Youtube

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Air Traffic Controller Salary In India Aai Atc Salary

Air Traffic Controller Salary In India Aai Atc Salary

Airport Operations Junior Executive Salary Structure Details With Real Salary Slip In Description Youtube

All About Filling Of Eform Aoc 4 Income Tax Return Indirect Tax Income Tax